Understanding VAT on Commercial Real Estate Transactions in the UAE

The Investor’s Guide to Navigating VAT on Commercial Sales in the UAE

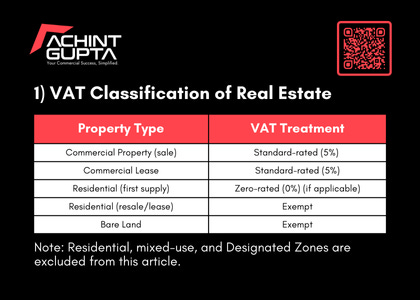

Commercial real estate transactions in the UAE are governed by specific Value Added Tax (VAT) rules outlined by the UAE Federal Tax Authority (FTA). Whether buying, selling, or leasing offices, warehouses, or retail spaces, it is essential to understand the VAT implications, particularly when investors are involved in secondary sales.

This article focuses on the sale and leasing of commercial real estate, with special emphasis on sales by investors, VAT registration obligations, recovery of input tax, and procedural requirements such as the Special Payment Mechanism.

2. VAT on Sale of Commercial Property (Focus: Investor-to-Business Sales)

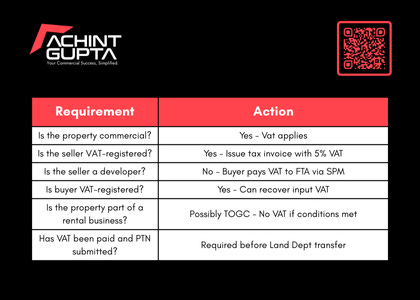

Under Article 2 of the UAE VAT Law, the sale of commercial property is considered a taxable supply at 5%. This applies whether the sale is by a developer or a secondary sale by an investor.

✅ Standard Rule

5% VAT must be charged on the total consideration.

If the seller is VAT-registered, they must issue a tax invoice.

Buyer (if registered) may claim the VAT as input tax, subject to usage conditions.

Sale by Investor – Special Payment Mechanism (SPM)

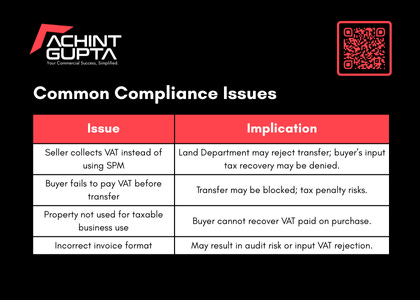

When an investor (non-developer) sells commercial property, the FTA requires that the buyer pays the VAT directly to the FTA, rather than to the seller. This is to ensure compliance and mitigate VAT risk at the point of title transfer.

📝 FTA Source:

Real Estate VAT Guide (VATGRE1) – Section 11.2 and 11.3

VAT Law Article 48, Executive Regulations Article 59

⚙️ Step-by-Step Procedure:

Seller issues invoice stating "VAT payable under special payment mechanism."

Buyer calculates VAT (5%) on the consideration.

Buyer generates a Payment Transaction Number (PTN) via the FTA e-Services portal.

Buyer pays VAT directly to the FTA through the designated channels.

Land Department requires proof of VAT payment (PTN) before completing title transfer.

Seller files VAT return showing output VAT as “paid by the buyer under SPM.”

🧾 Example 1 – Sale by VAT-Registered Investor (to Business Buyer)

Sale price: AED 10,000,000

Seller: VAT-registered investor

Buyer: VAT-registered company

Steps:

Seller issues invoice (AED 10M + VAT AED 500,000).

Buyer pays AED 500,000 VAT directly to FTA.

PTN submitted to Land Department.

Title transfer processed.

Buyer claims AED 500,000 as input VAT in their return.

Seller reports AED 500,000 as output VAT (with note it was paid under SPM).

Result: Neutral VAT impact for buyer; seller complies without collecting VAT.

🧾 Example 2 – Sale by Non-Registered Investor

Sale price: AED 5,000,000

Seller: Not VAT-registered

Buyer: VAT-registered entity

Steps

Seller issues invoice without VAT.

Buyer must:

Calculate and pay AED 250,000 (5%) VAT to FTA directly.

Provide PTN at Land Department.

Buyer reports the VAT as both output and input tax in their VAT return (self-accounting).

✅ FTA Basis: VATGRE1 confirms that if the seller is not registered but the supply is taxable, the buyer assumes VAT liability to ensure proper collection.

🔁 Transfer of a Going Concern (TOGC)

A sale of commercial property with ongoing lease agreements may qualify as a Transfer of a Going Concern, which is outside the scope of VAT.

📌 Conditions:

Buyer must be VAT-registered.

Buyer must continue the same business activity (e.g., leasing the same units).

The property must be a functioning rental business, not a vacant building.

🧾 Example 3 – TOGC Qualification

Seller owns a tenanted office building.

Buyer acquires building and continues renting to same tenants.

Both parties agree TOGC applies and retain documentation.

No VAT charged on sale.

✅ FTA Reference: VATGRE1 – Section 11.4

⚠️ Note: If conditions are not fully met, full VAT applies using the SPM.

Summary Checklist for Investor Property Sales