Dubai Commercial Office Investments 2025 - Strategic Opportunities for Individual Investors

Double-Digit Growth. Strong Yields. Limited Supply. Act Now

As of early 2025, Dubai’s commercial office space market continues to offer one of the most attractive combinations of rental income and capital appreciation globally, especially for individual investors. Off the back of a record 2023, the market has entered 2025 with strong momentum: high demand, limited supply, rising occupancy, and double-digit rental growth in key areas.

2025 Snapshot - Performance Drivers

Rents increased by 20–45% YoY across key districts in 2024, now stabilizing at elevated levels in early 2025

City-wide occupancy averages above 88%, with Grade A buildings nearing full capacity (90–95%)

Office sale transactions and values rose over 24% in 2024, maintaining investor confidence into 2025

Yields remain strong, averaging 7–9% gross annually, especially in strata office zones like Business Bay and JLT

Demand remains driven by corporate expansion, tech startups, and professional services firms relocating to Dubai

Top Performer Districts in 2025

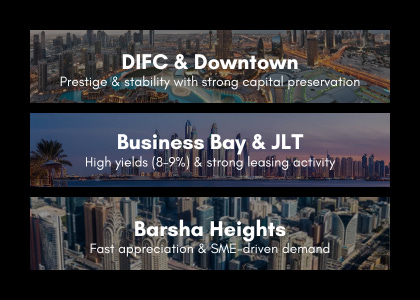

DIFC - Dubai’s financial heart, offering prestige, stability, and near 100% occupancy. Lower yields (6–7%) but strong capital preservation.

Downtown Dubai - Premium office space with high demand from multinationals. Offers capital appreciation and stable tenants.

Business Bay & JLT - Leading the way in yield-driven investments, offering 8–9% returns, strong leasing activity, and value growth.

Barsha Heights - Mid-market, high-demand zone for SMEs and digital firms, with fast appreciation and solid rental returns.

Emerging Office Hotspots to Watch in 2025

Several up-and-coming districts are gaining traction with investors seeking early-stage value buys.

* Motor City - A maturing mixed-use community with increasing office demand from fitness, wellness, and automotive sectors. Offers good 8%+ yields at a lower entry price.

* JVC (Jumeirah Village Circle) - Growing residential catchment has driven demand for small-format offices and co-working spaces. Ideal for investors targeting freelancers and consultancies.

* Arjan - Positioned as a rising hub for healthcare, education, and wellness businesses, Arjan is seeing increased investor attention with room for capital appreciation.

* Expo City Dubai - Positioned as a long-term innovation and logistics hub, Expo City is drawing large tenants and government-backed entities. Early investors could benefit from future upside as infrastructure expands.

Why Dubai’s Office Market Remains Investor-Friendly in 2025

Business licensing and free zones continue to expand across the emirate

Sustained tenant demand in core and secondary zones keeps pushing rents higher

Limited new office supply keeps vacancy low and rent growth high

Dubai’s position as a regional HQ hub for MENA, Africa, and South Asia remains unrivalled

No property tax and competitive service charges support healthy net yields

Strategic Tips for 2025 Investors

Target High-Yield Zones: Business Bay, JLT, Motor City, and Barsha Heights offer strong yields with manageable risk.

Anchor Your Portfolio in Prime: Add exposure to DIFC or Downtown to benefit from long-term capital preservation and global tenant demand.

Get Ahead of the Curve: Early investment in Expo City, Arjan, or JVC offers potential value appreciation as infrastructure and demand grow.

Focus on Quality Assets: Grade A buildings with amenities and strong property management attract higher rents and longer leases.

Flexible Lease Structures: With rising rents, negotiate shorter leases with built-in escalations or market-linked reviews.

Conclusion

Dubai’s commercial office sector in 2025 remains a high-performance investment class for individuals. Whether you’re focused on cash-flow via rental income or long-term capital gains, the current market landscape offers both — especially in high-demand and emerging districts.

With Dubai’s economy expanding, its population growing, and government vision (like D33 and the 2040 Master Plan) prioritizing sustainable business zones, this is a strategic window for investors to capitalize on the momentum.